Transferring Your UK Pension Assets to Portugal: Guidance for Expat Retirees

UK retirees moving to Portugal face complex pension and tax rules, needing careful financial planning

Retirees who plan to settle down in Portugal’s beautiful climate are often pleasantly surprised at how much further their hard-earned retirement savings and pensions will stretch. Many intend to buy a new property and enjoy a relaxed, laid-back lifestyle away from the pressures of work.

Pension funds and retirement wealth play a hugely important role in supporting those retirement aspirations, and time spent reviewing the options, deciding how and if to transfer a pension fund, and understanding how you will access and pay tax on pension incomes is always worthwhile.

The ideal is to work with an accomplished wealth manager who can factor in your risk tolerance, planned expenditures, and specific mix of pensions, assets, and investments. However, Chase Buchanan Private Wealth Management has put together some key information to ensure expatriate retirees intending to relocate to Portugal have oversight of all the most relevant factors.

Why Should UK Retirees Review Their Pension Arrangements Before Moving to Portugal?

Expats can choose multiple potential routes when deciding how to manage their pensions, from leaving them in the UK and accepting transfer and currency exchange costs to transferring to a Recognised Overseas Pension Scheme (ROPS), now with a larger tax burden, or restructuring pension savings into a Self-Invested Pension Plan (SIPP) to gain the best of both worlds.

In reality, there may be numerous decisions to make about each pension scheme and investment asset because the right moves will depend on a host of factors, such as:

The value, structure and nature of each element of your retirement savings

The tax reliefs, allowances and rates you’ll pay in each respective country

The flexibility of early access or lump sum drawdowns associated with each product

We often reiterate that there isn't a universal 'solution' that will make every client's pensions as tax efficient as possible or generate the best returns because every expatriate may have different objectives. Those could also change, such as opting for more risk-averse funds as you get closer to retirement or looking at ways to reinvest wealth to generate more stable returns.

Recent reforms announced by the UK government have also made pension transfers more complex. A transfer that might have seemed efficient and low-cost a few months ago may not now be quite so attractive.

What Are the Changes Impacting the Transfer of Pensions From the UK to Portugal?

Before the Autumn Budget in 2024, a large proportion of ROPS, a type of HMRC-approved overseas pension fund, were exempt from the Overseas Transfer Charge (OTC), provided the fund was based in a jurisdiction within the EU or Gibraltar.

Those exemptions have been lifted, which means more expatriates may be exposed to a significant 25% tax burden on the value of the pension fund being transferred. That also means the risks of proceeding with a transfer without expert cross-border taxation advice could carry a much higher risk.

The OTC isn’t a new tax, introduced in 2017, but the removal of these exemptions means any expat who is currently a UK resident or living elsewhere in the UK is exposed to the full 25% liability.

The ramifications may be wider reaching than you might think because the 25% tax rate doesn’t only affect expats planning to retire in Portugal in the immediate future who may need to rethink their plans, choose an alternative pension transfer strategy, or recalculate their retirement savings.

It also means that those intending to settle in Portugal later in life, who might still be some way away from retirement, need to consider their options, whether transferring earlier to reduce the overall liability or restricting pensions and retirement wealth sooner than they might have planned.

Some expats will likely opt for an SIPP transfer, which isn’t exposed to the OTC since the fund technically remains in the UK. Others may claim a UK-based pension from Portugal, but this also carries the risk of devaluations and uncertainty in payment values given the exchange rates and the costs of international payment charges.

Pension providers do not always offer the option to claim payments from overseas, so it’s important to review the terms attached to a pension fund before making any decisions.

How Are UK-Based Pension Schemes Taxed for British Expats Living in Portugal?

Another consideration is the tax obligation against pension incomes, both regular payments and lump sum drawdowns. If you intend to live full-time or primarily in Portugal, you'll usually become a tax resident, which means your worldwide income and assets are subject to Portuguese taxation.

There are further complications regarding dual tax treaties and assets that are technically exposed to tax in both jurisdictions, which reinforces the importance of specialist advice from a wealth manager or financial adviser well-versed in cross-border taxation.

However, you will also find that the tax deductions applied against pension payments can vary quite considerably depending on the nature of the fund.

Government service pensions, for example, are normally still fully taxable in the UK according to the prevailing rates and annual personal allowances and won’t be taxed in Portugal – even if you become a full-time tax resident.

Portuguese Tax Rates and Allowances Against Pension Incomes

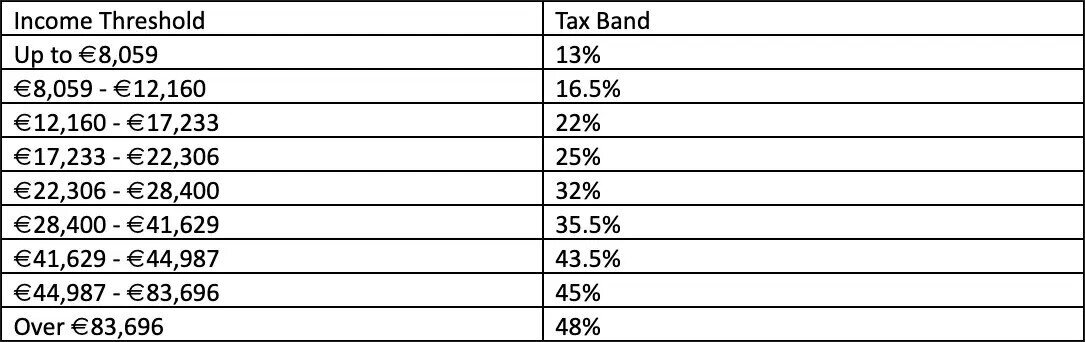

Most expats remain eligible for the UK State Pension, and you can elect to receive this in Portugal. The standard Portuguese personal allowance deduction of €4,349 applies, but so too do the current income tax rates, which are currently as follows:

Occupational pensions are normally taxed in the same way, but 25% tax-free pension lump sum drawdowns in the UK may not be tax-exempt in Portugal.

That means if an expat draws a 25% lump sum after becoming a Portuguese tax resident, it may also be subject to the current income tax rates.

Managing Tax Exposure on Personal Pension Income as a Portuguese Resident

In the UK, most pensions are taxed similarly, but in Portugal, personal pensions that do not receive employer contributions are taxed differently. They have a capital element, or the amount originally paid into the fund by the holder, which is tax-free.

The contrast is that the growth element, or the amount by which those contributions have increased in value, is taxable and classified as investment income, which means it is generally subject to a flat rate of 28% tax—something that could potentially be beneficial, especially for taxpayers who would otherwise be subject to the top rate of personal income tax.

This information highlights the complexities and changing nature of transferring a pension from the UK to Portugal and why there isn't a simple solution or a transfer option we'd recommend for every client.

Read more about Chase Buchanan - Chase Buchanan Private Wealth Management Publishes Informative ‘Moving to France’ Webinar for 2025

About Chase Buchanan Private Wealth Management

Chase Buchanan is a highly regulated wealth management company that specialises in providing global finance solutions for those with a global lifestyle. We are global financial advisers, supporting expatriates around the world from our regulated European headquarters, and local offices across Belgium, Canada, Canary Islands, Cyprus, France, Malta, Portugal, Spain, UK and the USA.

All investments carry risk, including the potential loss of capital. You should carefully consider whether investing is suitable for you, taking into account your personal circumstances, financial situation, and risk tolerance.

Chase Buchanan Ltd is authorised and regulated by the Cyprus Securities and Exchange Commission with CIF Licence 287/15.

Media Contact:

Chase Buchanan Ltd

+357 2501 0455